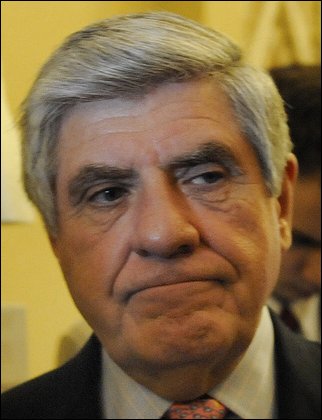

Following a failed attempt by Congressional Democrats to push forward a proposal for a war tax as part of the “Share the Sacrifice Act of 2010,” Senator Ben Nelson (D-NE) has floated the idea of war bonds as an alternative.

The Senate bill is extremely vague, but the new war bonds do not appear to differ materially from the Patriot Savings Bonds introduced by the Bush Administration in December 2001 as a way for Americans “to express their support for our nation’s anti-terrorism efforts.”

Rather than broad-based funding of the global war on terror, the new bonds would be presented as simply funding the Iraq and Afghan Wars. In practice, however, both bonds put all money borrowed directly into the general fund.

Though Senator Nelson believes the bonds would be a way to “pay” for the war, war bonds are simply a loan which the government would eventually be expected to repay, with interest. The benefit of borrowing from individual Americans instead of foreign corporations and governments is not immediately apparent, except that those foreign powers are growing reluctant to lend the enormous amounts of money needed to fund the endless wars.

The US has a long history of issuing war bonds to pay for its assorted conflicts, and has largely repaid those bonds. One major exception, however, was a series of “Liberty Bonds” issued in October 1918 to fund World War One. The bonds proscribed repayment in gold, but the House of Representatives passed a resolution in 1933 allowing them to default on this.